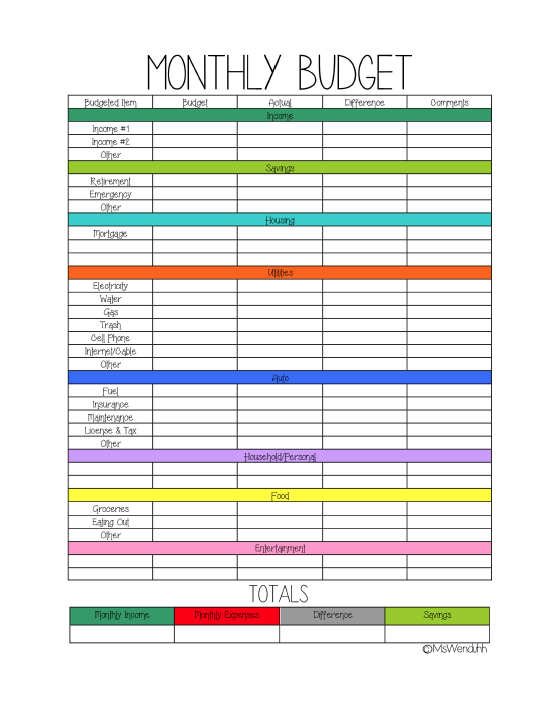

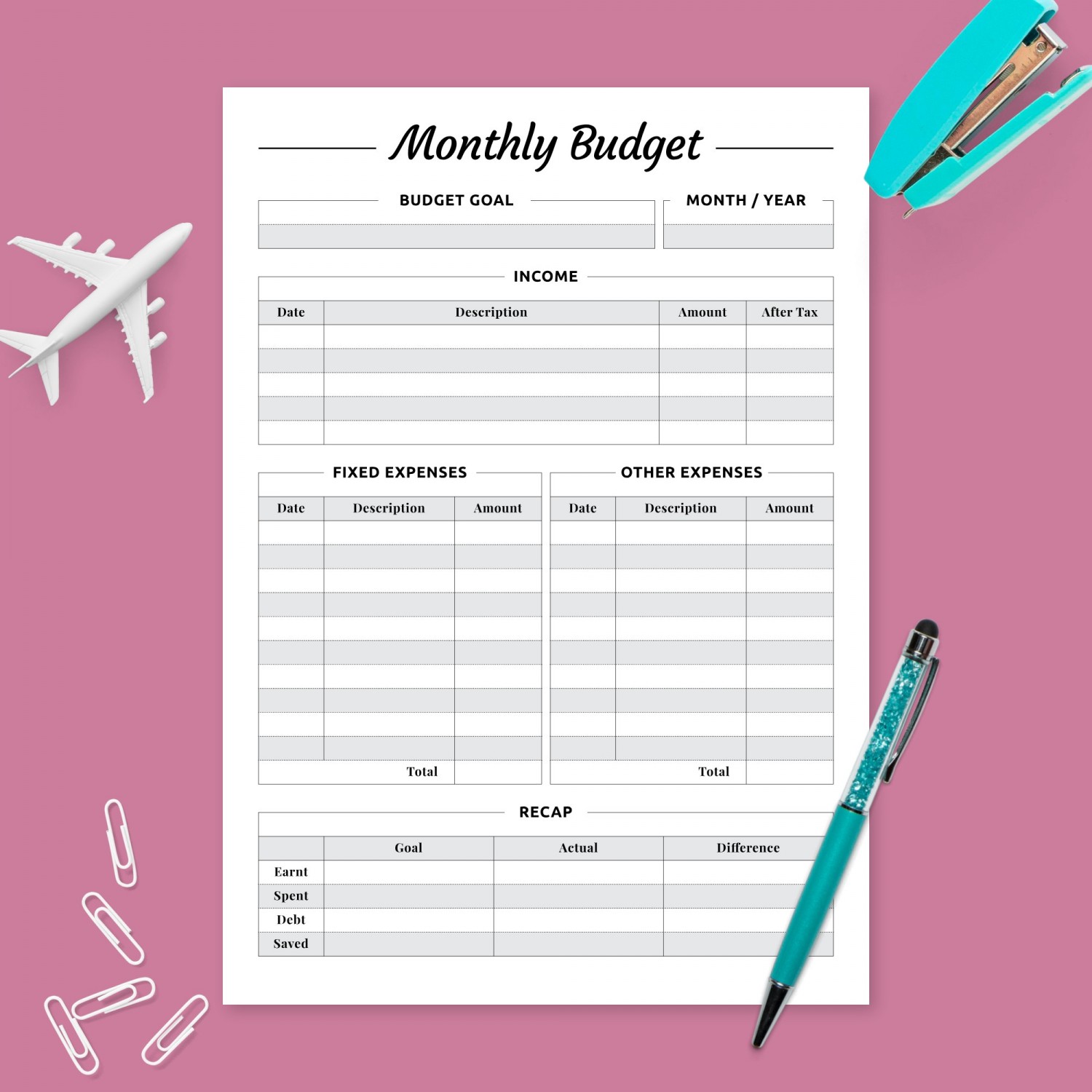

The ability to classify expenses by category also makes it easier for users to prepare tax returns at the end of the year because they have all the necessary information. This data collected in an organized manner allows users to set limits on specific spending categories and adjust their budget accordingly. The most important benefit of using a monthly expense tracker is seeing where one's money goes each month and identifying areas that need improvement. This tracker helps one track expenses in categories like food, rent or mortgage payments, utilities, transportation costs, and other miscellaneous items. It lets the user view their spending and saving habits at a glance, allowing them to make informed decisions about how they use their money. You don’t need any paper, calculator, or pencil because figures are automatically calculated for you.By subscribing, I consent to receiving emails. This easy to use Google spreadsheet makes budgeting quick and painless.

FREE PRINTABLE BUDGET PLANNER PDF DOWNLOAD

Go digital and download the Mom Beach Monthly Budgeting Spreadsheet.

FREE PRINTABLE BUDGET PLANNER PDF FREE

What worked and what didn’t? What can you do different next month to improve your financial situation? Get the Free Printable Budget Planner – The Busy Mom Budget Planner Now! Mom Beach Monthly Budgeting Spreadsheet Monthly Check-InĪt the end of the month, you should evaluate how you did. When you track your finances, you tend to not spend as much and are careful how you spend money. With the weekly spending log, you can track how much money you are spending each week.

You can see the amount of money you actually have. When you have cash on hand, you avoid spending as much money. How long can you go without spending any money? Some tips to help you avoid spending are to cook at home instead of eat out and use cash instead of your credit or debit card. You can print out as many copies of this worksheet as you want and stick it in your binder.įor each month, there is a monthly expenses log, no spend days challenge worksheet, weekly spending, and a monthly check-in! This free printable budget planner helps you keep track of online bill payments with a handy worksheet.

When you budget your finances, paying off debt becomes simple!

The Busy Mom Budget Planner comes with 3 debt trackers and you can print more off if you’d like. Use the Trim personal finance bot to see how else you can lower your monthly expenses.

By switching, you can get on a new promotional plan and save money. How much are you really watching Netflix each month? Can you do without any subscription boxes?ĭid you know that if you switch providers every year, you can lower your utility bills? There is more than one electricity provider in your area usually. Are there any recurring expenses that you can do without? Maybe you can trim the fat off some expenses by switching providers or canceling subscriptions. The Busy Mom Budget Planner has worksheets to document your yearly, quarterly, and monthly recurring expenses. The Busy Mom Budget Planner comes with a yearly financial goal worksheet and 5 goal setting worksheets. To get started with any budget plan, you must start with defining your goals. This free printable budget planner, the Busy Mom Budget Planner, is sure to help you with your budgeting needs. It can be tough sticking to a budget each month, but is necessary if you want to save money.

0 kommentar(er)

0 kommentar(er)